全球动力电池“半年考”解析

日前,SNE Research发布今年1-6月全球市场动力电池装机量TOP 10榜单,中国企业依旧占据6席。这里就榜单相关数据进行梳理,以供参考。

SNE Research统计数据显示,2024年1-6月,全球市场电动汽车(EV、PHEV、HEV)动力电池装机量约364.6GWh,同比增长22.3%。

单位:GWh 数据来源:SNE Research

从全球市场动力电池装机量TOP 10来看,今年上半年,宁德时代(中国)以137.7GWh的装机量稳居首位,同比增长29.5%,市占率37.8%;比亚迪(中国)以57.5GWh的装机量排名第二,同比增长22.0%,市占率15.8%;LG新能源(韩国)的电池装机量为46.9GWh,市占率12.9%,排名第三。

同期,动力电池装机量排名第四名至第十名的电池企业分别是:SK On(韩国)、中创新航(中国)、三星SDI(韩国)、松下(日本)、国轩高科(中国)、亿纬锂能(中国)、欣旺达(中国),市占率分别为4.8%、4.6%、4.5%、4.4%、2.5%、2.1%和2.1%。

01

动力电池“半年考”解析

整体上,全球市场动力电池装机“半年考”的看点主要表现在以下几个方面:

一是,中国电池企业全球市场动力电池装机(TOP 10企业)合计份额近65%。

在全球市场动力电池装机量TOP 10企业中,中国、韩国、日本电池企业装机量分别为236.2GWh、80.6GWh、16.2GWh,市占率分别为64.9%、22.2%、4.4%,中国企业装机量持续领跑,且领先优势明显。

二是,中国电池企业“半年考”均实现两位数的同比增长。

从同比增长情况来看,全球TOP 10企业同比增长最快的前三家企业均为中国企业,分别是欣旺达、国轩高科、中创新航,同比分别增长62.4%、38.2%、34.6%。同时,宁德时代、比亚迪、亿纬锂能这三家中国企业均实现超18%的同比增长,表现出强劲的增长势头。

其中,欣旺达表现最为活跃。资料显示,欣旺达已配套大众混动海外版全系列、沃尔沃GPA全系列等海外品牌部分车型,并与理想、小鹏、零跑、吉利、东风、广汽、上汽等主流品牌形成长期稳定的合作。另据媒体消息,欣旺达已获得理想M8、M7以及小米第三款车型的电池定点项目。

三是,韩国、日本电池企业装机排名有所调整。

今年1-6月,韩国三家电池企业的装机量实现5.4%~17.4%的同比增长,而日本松下电池装机量同比则下降25.1%。

从排名看,与去年同期相比,SK On上升一名来到第四名,松下电池从第四名下滑至第七名。

松下电池是全球TOP 10企业中唯一一家装机量下滑的企业,松下方面近期已下调其动力电池目标产量,将2030财年的电动汽车电池生产目标从原来的200GWh下调至150GWh,减少约30%。据介绍,这一决定主要由于其对特斯拉和其他美国公司的供应减少。

四是,全球TOP 3企业合计市占率达66.5%。

上半年,全球TOP 3企业共同瓜分了全球约三分之二的电动汽车的配套装机量。同时,第四名到第十名电池企业合计装机份额为25%,与TOP 3企业装机量仍有较大差距。

02

动力电池竞争趋势

时间已来到第三季度,在电池中国看来,汽车产业的价格竞争持续背景下,今年下半年动力电池装机量竞争或将呈现以下趋势:

其一,包括Stellantis、通用、现代、大众等多家欧洲车企,均已表明将在入门级车型导入磷酸铁锂电池。因此,欧洲等市场对磷酸铁锂电池的需求或将逐渐起量,而拥有全球超90%LFP电池产能的中国电池企业,或将为全球市场提供更多支持。

其二,受特斯拉4680大圆柱电池量产的带动影响,多家中国、韩国、日本的电池企业都计划在今年年内实现大圆柱电池的量产。

电池配套方面,中国的宁德时代、亿纬锂能和远景动力已成为宝马集团的大圆柱电池供应商;新品布局方面,亿纬锂能发布大圆柱Omnicell全能电池、国轩高科推出三元体系46大圆柱产品——星晨电池,正力新能发布“正力·骐龙”大圆柱电池系统,力神电池、比克电池等企业也已发布大圆柱电池新品。预计到今年年底,或将出现一波大圆柱电池量产潮,从而带动中国企业装机量进一步提高。

其三,技术迭代方面,2024年以来,超快充电池逐渐成为中高端电动汽车的标配。

在10分钟充电至80%SOC,或充电5-10分钟实现续航300-500公里的需求推动下,包括宁德时代、亿纬锂能、国轩高科、巨湾技研、力神电池、瑞浦兰钧、正力新能、孚能科技、兰钧新能源等电池企业4C-6C超快充电池正加速配套下游新车型,将持续带动自身装机量的提高。

其四,海外市场(除中国市场以外的全球其它市场)仍将是下半年装机量保持快速增长的关键之一。

单位:GWh 数据来源:SNE Research

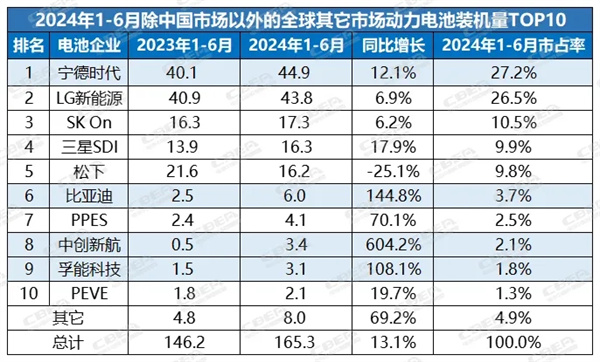

SNE Research数据显示,2024年1-6月,海外市场(除中国市场以外的全球其它市场)电动汽车动力电池装机量约为165.3GWh,同比增长13.1%。

值得一提的是,从同比增长情况来看,今年上半年,中创新航、比亚迪、孚能科技这三家中国企业实现同比三位数的增长,在该榜单中成绩亮眼。其中,中创新航更是实现同比6倍的高速增长。

从海外电池产能布局看,多家中国企业海外建厂进入到实质性阶段或已实现电池本地化配套。其中,宁德时代德国电池工厂已投产,其匈牙利工厂正在建设中。

亿纬锂能马来西亚、匈牙利电池工厂也在建设中;基于CLS全球合作经营模式(CLS是合作Cooperation、技术许可Licence和服务Service的英文缩写),亿纬锂能和康明斯、戴姆勒卡车、佩卡的合资电池工厂也已动工。该工厂将生产方形磷酸铁锂电池,主要应用于指定的北美商用车领域,规划年产能约21GWh,预计2026年开始出货。

国轩高科德国哥廷根工厂、美国弗里蒙特工厂、泰国合资工厂已相继投产,还计划在摩洛哥新建电池工厂,不断扩大其海外产能供给。

孚能科技土耳其电池工厂的年产6GWh的模组和电池包产线已于2023年3月投产,形成对欧洲、中东、非洲、南亚业务拓展的支持能力。

远景动力、蜂巢能源等企业的海外工厂也已实现电池本地化供应。中国企业全球化供货能力持续增强,且海外市场(除中国市场以外的全球其它市场)也已成为中国企业提升电池装机量的重要阵地。

有行业机构预计,今年下半年,锂电池主要金属价格将保持相对稳定或小幅波动,叠加车企冲击电动汽车全年产销量目标的影响,或将在一定程度上缓解市场对动力电池需求放缓的问题,使电池需求保持增长;中国市场6月新能源汽车新车单月渗透率首次突破50%,呈加速替代燃油车之势,这也对动力电池需求持续增长将提供有力支撑。

Recently, SNE Research released the top 10 list of global market installed power battery capacity from January to June this year, with Chinese companies still occupying 6 seats. Here is a summary of the data related to the rankings for reference.

According to SNE Research statistics, from January to June 2024, the installed capacity of power batteries for electric vehicles (EV, PHEV, HEV) in the global market was approximately 364.6 GWh, a year-on-year increase of 22.3%.

Analysis of the Global Half Year Test for Power Batteries

Unit: GWh Data source: SNE Research

From the top 10 global market installed capacity of power batteries, in the first half of this year, CATL (China) ranked first with an installed capacity of 137.7 GWh, a year-on-year increase of 29.5%, and a market share of 37.8%; BYD (China) ranked second with an installed capacity of 57.5GWh, a year-on-year increase of 22.0%, and a market share of 15.8%; LG New Energy (South Korea) has a battery installed capacity of 46.9 GWh and a market share of 12.9%, ranking third.

During the same period, the battery companies ranked fourth to tenth in terms of installed capacity of power batteries were SK On (South Korea), China Innovation Airlines (China), Samsung SDI (South Korea), Panasonic (Japan), Guoxuan High Tech (China), EVE Energy (China), and Xinwangda (China), with market share of 4.8%, 4.6%, 4.5%, 4.4%, 2.5%, 2.1%, and 2.1%, respectively.

01

Analysis of the "Half Year Test" for Power Batteries

Overall, the highlights of the "half year test" of power battery installation in the global market are mainly reflected in the following aspects:

Firstly, Chinese battery companies have a combined share of nearly 65% in the global market for installed power batteries among the top 10 companies.

Among the top 10 companies in the global market for installed power battery capacity, Chinese, South Korean, and Japanese battery companies have installed capacity of 236.2 GWh, 80.6 GWh, and 16.2 GWh, respectively, with market share of 64.9%, 22.2%, and 4.4%, respectively. Chinese companies continue to lead in installed capacity, and their leading advantage is obvious.

Secondly, Chinese battery companies have achieved double-digit year-on-year growth in the "half year exam".

From the perspective of year-on-year growth, the top three companies with the fastest year-on-year growth in the world's top 10 enterprises are all Chinese companies, namely Xinwangda, Guoxuan High tech, and Zhongchuang Chuanghang, with year-on-year growth of 62.4%, 38.2%, and 34.6%, respectively. Meanwhile, three Chinese companies, CATL, BYD, and EVE Energy, all achieved a year-on-year growth of over 18%, demonstrating strong growth momentum.

Among them, Xinwangda showed the most active performance. According to the data, Xinwangda has been equipped with some models from overseas brands such as Volkswagen Hybrid Overseas Edition and Volvo GPA, and has formed long-term and stable cooperation with mainstream brands such as Ideal, Xiaopeng, Zero Run, Geely, Dongfeng, GAC, and SAIC. According to media reports, Xinwangda has been awarded the battery spot project for the Ideal M8, M7, and Xiaomi's third model.

Thirdly, the installed capacity rankings of battery companies in South Korea and Japan have been adjusted.

From January to June this year, the installed capacity of three battery companies in South Korea achieved a year-on-year growth of 5.4% to 17.4%, while the installed capacity of Panasonic batteries in Japan decreased by 25.1% year-on-year.

From the ranking, compared with the same period last year, SK On rose one place to fourth place, while Panasonic Battery fell from fourth place to seventh place.

Panasonic Battery is the only company among the top 10 global enterprises with a decline in installed capacity. Recently, Panasonic has lowered its target production of power batteries, reducing its electric vehicle battery production target for the 2030 fiscal year from the original 200GWh to 150GWh, a decrease of about 30%. It is reported that this decision is mainly due to a reduction in its supply to Tesla and other American companies.

Fourthly, the combined market share of the top 3 global companies reached 66.5%.

In the first half of the year, the top three global companies jointly shared about two-thirds of the installed capacity of electric vehicles worldwide. Meanwhile, the total installed capacity share of the fourth to tenth ranked battery companies is 25%, which still has a significant gap compared to the top three companies in terms of installed capacity.

02

Competitive Trends in Power Batteries

As we enter the third quarter, in the view of Battery China, with the continuous price competition in the automotive industry, the competition for installed power battery capacity in the second half of this year may show the following trends:

Firstly, several European car companies, including Stellantis, General Motors, Hyundai, and Volkswagen, have indicated their intention to introduce lithium iron phosphate batteries into their entry-level models. Therefore, the demand for lithium iron phosphate batteries in markets such as Europe may gradually increase, and Chinese battery companies with over 90% of global LFP battery production capacity may provide more support for the global market.

Secondly, driven by the mass production of Tesla's 4680 large cylindrical battery, several battery companies in China, South Korea, and Japan plan to achieve mass production of large cylindrical batteries within this year.

In terms of battery matching, China's CATL, EVE Energy, and Yuanjing Power have become suppliers of large cylindrical batteries for BMW Group; In terms of new product layout, EVE Energy has released the Omnicell universal cylindrical battery, Guoxuan High tech has launched the Xingchen battery, a ternary system with 46 large cylindrical products, and Zhengli New Energy has released the "Zhengli Qilong" large cylindrical battery system. Companies such as Lishen Battery and Bike Battery have also released new large cylindrical battery products. It is expected that by the end of this year, there will be a wave of mass production of large cylindrical batteries, which will further increase the installed capacity of Chinese enterprises.

Thirdly, in terms of technological iteration, since 2024, ultra fast charging batteries have gradually become a standard configuration for mid to high end electric vehicles.

Driven by the demand for charging to 80% SOC in 10 minutes or achieving a range of 300-500 kilometers in 5-10 minutes, battery companies such as CATL, EVE Energy, Guoxuan High Tech, Juwan Technology Research, Lishen Battery, Ruipu Lanjun, Zhengli New Energy, Funeng Technology, and Lanjun New Energy are accelerating the matching of 4C-6C ultra fast charging batteries with downstream new vehicle models, which will continue to drive the increase of their installed capacity.

Fourthly, overseas markets (excluding the Chinese market) will remain one of the key factors for maintaining rapid growth in installed capacity in the second half of the year.

Analysis of the Global Half Year Test for Power Batteries

Unit: GWh Data source: SNE Research

According to SNE Research data, from January to June 2024, the installed capacity of electric vehicle power batteries in overseas markets (excluding the Chinese market) was approximately 165.3 GWh, a year-on-year increase of 13.1%.

It is worth mentioning that in terms of year-on-year growth, in the first half of this year, three Chinese companies, China Innovation Aviation, BYD, and Funeng Technology, achieved double-digit year-on-year growth, which is impressive in this list. Among them, China Innovation Airlines achieved a high-speed growth of six times year-on-year.

From the perspective of overseas battery production capacity layout, multiple Chinese companies have entered a substantive stage of building factories overseas or have already achieved localized battery support. Among them, CATL's German battery factory has been put into operation, and its Hungarian factory is under construction.

EVE Energy's battery factories in Malaysia and Hungary are also under construction; Based on the CLS global cooperative business model (CLS stands for Cooperative, Technology License, and Service), the joint venture battery factory between EVE Energy and Cummins, Daimler Trucks, and Pekka has also started construction. The factory will produce square lithium iron phosphate batteries, mainly used in designated North American commercial vehicle fields, with a planned annual production capacity of approximately 21GWh, and is expected to start shipping in 2026.

Guoxuan High Tech's G ö ttingen factory in Germany, Fremont factory in the United States, and joint venture factory in Thailand have all started production. They also plan to build a new battery factory in Morocco to continuously expand their overseas production capacity and supply.

The module and battery production line with an annual output of 6GWh in the battery factory of Funeng Technology in Türkiye has been put into operation in March 2023, forming the ability to support business expansion in Europe, the Middle East, Africa and South Asia.

Overseas factories of companies such as Far East Power and Honeycomb Energy have also achieved localized supply of batteries. The global supply capacity of Chinese enterprises continues to strengthen, and overseas markets (excluding the Chinese market) have also become an important battlefield for Chinese enterprises to increase their battery installed capacity.

Industry organizations predict that in the second half of this year, the prices of major metals in lithium batteries will remain relatively stable or fluctuate slightly. Coupled with the impact of car companies' impact on the annual production and sales targets of electric vehicles, this may to some extent alleviate the problem of slowing down market demand for power batteries and maintain growth in battery demand; In June, the monthly penetration rate of new energy vehicles in the Chinese market exceeded 50% for the first time, showing an accelerating trend of replacing fuel vehicles. This will also provide strong support for the continued growth of demand for power batteries.